My Jag is a lease so there's no turn-in monies to apply. I have to put down a $1000 non-refundable deposit that can either be applied to the lease or I can get it back at delivery. If you wouldn't mind explain how to calculate a lease, I'd be appreciative. We're leasers so buying isn't of interest.

Thanks so much!

Sure - here goes. You'll never need a lease calculator again, hopefully.

There are three components of a lease payment:

(1) Depreciation, (2) Interest or the rent charge, (3) Sales Tax (can't avoid it). I will discuss each in turn.

(1) Depreciation

This is the difference between the net capitalized cost (NCC) and the residual. What is the NCC? The NCC is the negotiated price of the vehicle less rebates and down payment plus fees - think of it as the total amount that you are borrowing. In most leases, this is why negotiating the price of the car is just as important as if you were buying the vehicle. But, in the case of the Telluride, there isn't much negotiating room on price.

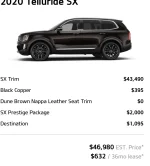

For the SX-P, let's say your MSRP is: 48,000. (Normally you'd negotiate lower than this.) Let's also assume a 0 down payment lease (only way to begin to compare lease offers).

NCC = 48,000 MSRP

- 0 (down payment / trade equity)

- 2000 factory incentive / rebate (KMF has lease cash for different terms)

+ 650 (KMF lease fee)

+ Fees (doc fees, dealer fee, possibly sales tax - for now, let's just say $300)

So, net cap cost is $46,950.

Now, you need the residual. Residual values (percent of MSRP) are set by the manufacturer and/or leasing company. Luxury vehicles set them artificially high to hide the true depreciation from the customer, but that's another discussion. These residual values are hidden from consumers as they come from a subscription service, but you can get it. For the Telluride, a 3 year residual percentage has been 59-61%. You can see the values in the KMF lease calculator by dividing the residual value listed by the MSRP of the vehicle. The actual residual you get will depend on your negotiated mileage. Also, it is always a percentage of MSRP - not negotiated price nor Net Cap Cost - so that's very important. For our example, let's assume 59%.

Residual value example = 59% * 48,000 = $28,320

Okay, now you can calculate (1):

Net Cap Cost - Residual = $46,950 - 28,320 = $18,630

Your total depreciation expense (plus fees if zero down) is $18630. Monthly,

$18630 / 36 = $517.50

So, anything higher than that is either taxes, additional fees /markup or part of the rent charge. $670-517.50 = $152.50

(2) Rent / Finance Charge

Here's where the money factor rears it's ugly head. Your monthly finance charge is equal to:

(NCC + Residual) * Money Factor = Monthly Rent Charge

What is the money factor? It's the equivalent of the APR (annual interest rate divided by 2400). For many KMF leases on an SX (no special) a common APR is 4.8% or higher - which equates to a money factor of 4.8/2400 = .002.

Using our example,

(46,950 + 28,320) * .002 = $150.54

$150.54*36 = total rent charge = $5419.44

Effectively, with this money factor and deal, one would be paying $5419 in interest expense or rent charge for 3 years. Above $5k is very common for this number in KMF leases for SX - there are no specials.

(3) Sales Tax:

The amount of sales tax due varies by state. In some states like Texas, lessees get screwed because they pay sales tax on the negotiated price of the vehicle (less trade in value). In other states like Georgia, the lessee only pays sales tax on the total of lease payments (a percentage of (1) + (2), for example).

If you are in a state like Georgia, then you'd calculate monthly tax as say 8%*(150.54+517.50) = $53.44 per month (if sales tax rate is 8% in GA - probably lower).

If you are in a state like Texas, you'd pay

.0625*$46000 (sales price less rebate) = $2875 in sales tax which would be added to the fees section of the net cap cost and affect the total depreciation payment AND the total interest payment.

So, in a state in which sales tax is charged on the total of payments you'd have:

$517.50+150.54+$53.44 = $721.48

In a state like Texas, you'd add the $2875 to net cap cost and work from there... factoring sales tax into (1) and (2).

(1) (46,950+2875-28320) / 36= $597.36

(2) (49,825 + 28320) *.002 = $156.29

Total lease payment = $753.65

Keep in mind some dealers will add the first month's payment to the NCC also - so nothing is due at signing - but then you're looking at 35 payments total.

So there is a worked example, you'll have to put your numbers in to see if you're happy with the rent charge or not. $670 is pretty typical for a zero down SX lease - not great, as rent charge is quite high.

Also, don't forget about the lease disposition fee... KMF charges a fee when the vehicle is turned in or in the case of a purchase.

When evaluating a lease, I usually remove sales tax and compare the total of payments to the depreciation... anything above that is the rent charge. If it's too high I try and negotiate the money factor way down.

KMF purchase rates are around 1.75% - 2.75 % for 48-60 mo terms... much better than nearly 5% annualized lease rate!

Hope that helps - wrote this from my phone, so let me know if you have any questions - I may have made a typo.