internetgirl6191

New member

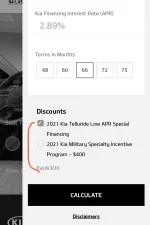

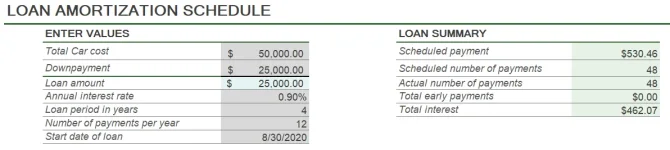

Vin # was created July 7th and just received an eta from the dealership of 8/8/2020. From looking at the KIA website, 1.9%+ financing is being offered through August 3rd. We wanted to get the ball rolling on financing paperwork but our salesman says it's too soon. Anyone know if the rate is going to change after August 3rd? For anyone interested in my process, SXP + T order was placed around 2/18/20 w/Austin, TX dealership. When the order was placed was told the delivery would be in September so August is a happy surprise.