BasilFawlty

Well-known member

My SX is scheduled for delivery to a dealer in Texas on Friday 23 October 20 (I live in New Mexico). Everthing is set except we have one small discrepancy to resolve. The Dealer insists they must collect the New Mexico tax when I take delivery. All fine and dandy, except they are saying the tax I'll need to pay is based on the normal gross receipts tax for my location (something like 8.1875% I think).

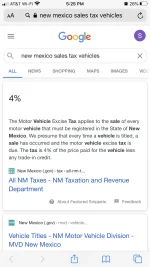

In actual fact, the New Mexico tax on a new car is 4% of the sales price (I have confirmed this with New Mexico MVD). I sincerely hope they will conclude and agree that the tax I need to pay is based on the 4% that New Mexico actually requires on new cars and not try to stick me with normal gross receipts tax which is more than double the real required amount.

In actual fact, the New Mexico tax on a new car is 4% of the sales price (I have confirmed this with New Mexico MVD). I sincerely hope they will conclude and agree that the tax I need to pay is based on the 4% that New Mexico actually requires on new cars and not try to stick me with normal gross receipts tax which is more than double the real required amount.